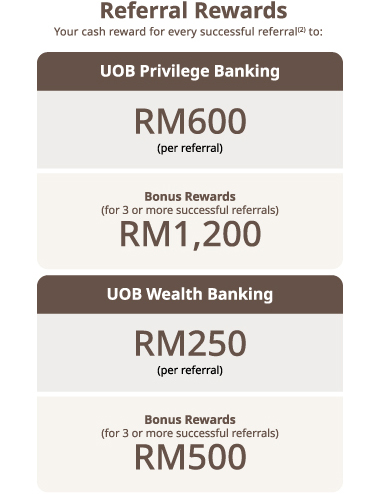

Get rewarded for every successful referral joining UOB Privilege Banking (PV) with a minimum Asset Under Management (AUM)* of RM500,000 or UOB Wealth Banking (WB) with a minimum AUM* of RM150,000.

Start a UOB Wealth Banking relationship with us today

Sign up as UOB Wealth Banking customer with a minimum of RM150,000 qualifying assets under management in deposits, bancassurance and/or investments with us. Terms and conditions apply.

Things you should know

Important notice and disclaimer

Terms and conditions apply.

Member of PIDM.

UOB deposits are protected by PIDM for up to RM250,000 for each depositor.

(1) Open to all individual customers of UOB Malaysia.

2) New-to-Bank Referred Customer is defined as a customer who is not currently a Privilege Banking or Wealth Banking customer of UOB Malaysia, and if Referred Customer has previously held any deposit/investment accounts with UOB Malaysia, the closure of such accounts shall be more than twelve (12) months prior to the Campaign Period.

(3) The Referrers who fulfil the Qualifying Criteria will receive rewards based on the number of successful referrals.

(4) There are no limits or restrictions to the number of referrals that can be made by an Eligible Customer throughout the Campaign Period.

*Asset Under Management (AUM) refers to deposits, investments and bancassurance which include conventional and Islamic savings accounts, current accounts, fixed deposit accounts, unit trusts, retail bonds and other structured investment products (or such deposits, investments and bancassurance as UOB Malaysia may decide from time to time).

Terms and conditions

Terms and conditions l ENG