Introduction

A structured investment is a flexible investment solution, where the payoff is linked to the performance of one or more underlying assets. Structured investments are fully customisable and can be tailored to your specific values, interests, market views and risk appetite.

Fully customised sustainable investments

We offer structured investments linked to the equities of companies with strong ESG ratings.

These sustainable companies are evaluated, screened and ranked by our partner Societe Generale’s responsible investments research team, a recognised leader in the field that issues quantitative ESG rankings to over 4,000 stocks worldwide. This evaluation also harnesses raw data tracked by Sustainalytics, the world’s largest independent provider of ESG research.

Of all the sustainable investment offerings we carry, our structured investments have the greatest scope for customisation.

Underlying Assets or Investment Themes

You have full control over what kind of companies to link your payoff to. You could choose companies grouped according to ESG themes you find compelling, such as those involved in clean energy or global healthcare. Or you could choose to link your structured investments to certain green companies, for instance, those involved in advancing clean energy, clean water or resource conservation.

Tenure

Choose the time horizon for these linked assets, ranging from a month to 24 months.

Risk Profile

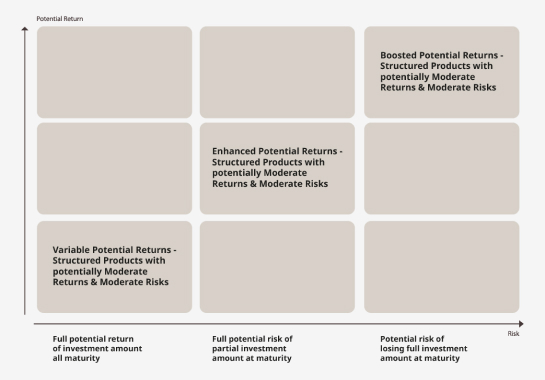

Your structured investment can also be specially designed to suit your individual risk appetite and investment objectives. You can choose from structured investments falling into any of the broad categories depicted below, each with differing potential risks and returns.

Start a UOB Wealth Banking relationship with us today

Sign up as UOB Wealth Banking customer with a minimum of RM150,000 qualifying assets under management in deposits, bancassurance and/or investments with us. Terms and conditions apply.